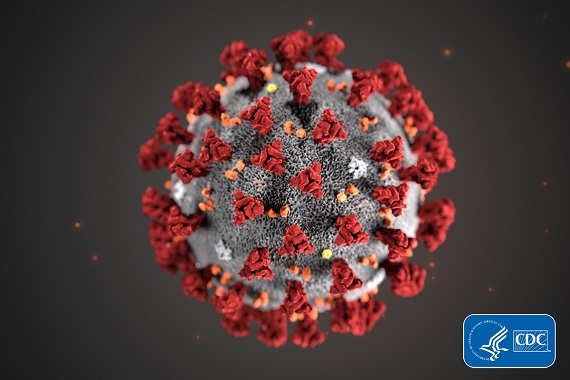

The coronavirus, also known as COVID19, originated in China, and has spread to at many other countries – the New York Times has an updated coronavirus tracking map where you can follow the outbreak across the globe. As of today, there are 60 identified cases in the U.S. – check the map for state breakdowns. We don’t yet know how we will be affected in the U.S. – we can only see that it spreads rapidly and viruses don’t respect borders.

As with many emerging illnesses, there’s a lot of fear about the potential impact. There’s also quite a bit of misinformation and many myths are circulating already. Fear and over-reaction create many additional problems. In times of health emergencies, it’s important to rely on trusted and authorized sources of information. Here in the U.S., the Centers for Disease Control & Prevention (CDC) has a dedicated coronavirus site with information for the public about how the illness spreads, symptoms, testing, FAQs, fact sheets and more. Coronavirus disease (COVID-19) outbreak, web resources from the World Health Organization (WHO), includes helpful, reputable information. Be careful about any information that you see posted on social media – make sure you know your source.

It’s important to keep perspective. From what we know now, coronavirus has high contagion but relatively low number of deaths in proportion to cases. Like influenza, it is of most concern to elderly and people with compromised immune systems. Remember, our usual flu season is still in progress, and the CDC estimates that between Oct. 1 and Feb. 15, seasonal influenza, aka “the flu.” has claimed the lives of 16,000 people.

This 10-minute video interviews two pathologists about the most common myths about the coronavirus, while presenting many facts about the disease and offering sensible advice for self protection.

CDC Coronavirus Prevention Guidance

There is currently no vaccine to prevent coronavirus, but the best way to prevent the disease includes the everyday prevention methods that help spread of respiratory diseases, influenza and other viruses. The CDC says:

- Avoid close contact with people who are sick.

- Avoid touching your eyes, nose, and mouth.

- Stay home when you are sick.

- Cover your cough or sneeze with a tissue, then throw the tissue in the trash.

- Clean and disinfect frequently touched objects and surfaces using a regular household cleaning spray or wipe.

- Follow CDC’s recommendations for using a facemask.: CDC does not recommend that people who are well wear a facemask to protect themselves from respiratory diseases, including COVID19. Facemasks should be used by people who show symptoms of COVID19 to help prevent the spread of the disease to others. The use of facemasks is also crucial for health workers and people who are taking care of someone in close settings (at home or in a health care facility).

- Wash your hands often with soap and water for at least 20 seconds, especially after going to the bathroom; before eating; and after blowing your nose, coughing, or sneezing.

- If soap and water are not readily available, use an alcohol-based hand sanitizer with at least 60% alcohol. Always wash hands with soap and water if hands are visibly dirty.

Travel issues and travel insurance

One big issue that people are questioning is whether it’s safe to travel. Right now, the countries on highest alert for travel are China and South Korea. The CDC is also warning travelers to Italy, Iran, and Japan to “practice enhanced precautions.” Check the CDC travel health advisories and the State Department’s travel advisories for the current status of countries you may be planning to visit. For more information, see CDC Travel.

The next question people have is if they should reschedule travel, and whether travel insurance will cover them if they have to cancel or have travel disrupted due to coronavirus. The bad news is, not always – it depends. It’s important to know the extent of your travel coverage and understand what is and what isn’t covered. PropertyCasualty360 addresses this in their article: Will travel insurance cover coronavirus?

“Tour operators and travel insurance brokers are reporting an increasing number of requests from customers asking to change their travel plans. Meanwhile, many U.S. airlines, including United, America and Delta, have canceled several flights to China.

Consumers may be surprised to learn that in either situation, their travel policy probably wouldn’t cover them.”

Most travel insurance is designed to protect you in case you need to cancel a trip, lose belongings, or require medical attention. But for cancellations related to coronavirus, only certain reasons qualify.”

They discuss the various scenarios in which a traveler may be covered, and those in which the traveler would not be. If you are planning a trip, it’s worth reading. And for more good travel planning advice, see Consumer Reports: How the Spread of Coronavirus Could Affect Your Travel Plans.

Additional coronavirus resources

Here are a few other resources that we’ve found helpful:

- CDC Fact sheet: What you need to know about coronavirus disease 2019 (PDF, also available in Spanish)

- CDC Interim Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19), February 2020

- New York Times: How to Prepare for the Coronavirus – Experts advise people to use common sense, including frequently washing hands, getting the flu vaccine and keeping a supply of your normal medications on hand. Also see the NYT’s frequently updated heath news for the latest on coronavirus.

- Vox media: 11 questions about the Covid-19 coronavirus outbreak, answered

Reprinted from Renaissance Alliance – no usage without permission.